Understanding the Dynamics of Online Forex Trading 1936400688

Online Forex trading has revolutionized the financial landscape, allowing traders to engage with global markets conveniently from their homes. With the rise of digital platforms, trading currencies has become more accessible than ever before. As a novice or experienced trader, understanding the fundamental principles and strategies of Forex trading is crucial for success. Among various options, seeking the right assistance can be invaluable. For instance, online forex trading South Africa Brokers can provide local insights and specialized services tailored to your trading needs.

An Introduction to Forex Trading

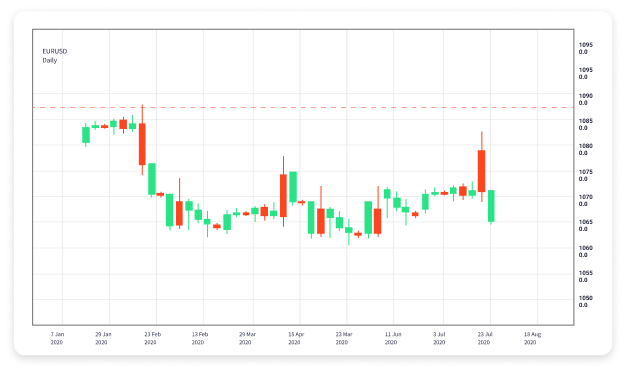

Forex trading, or foreign exchange trading, involves the buying and selling of currency pairs in the international financial market. Unlike stock markets, the Forex market operates 24 hours a day, five days a week, making it the largest and most liquid market in the world. The major currency pairs include EUR/USD, USD/JPY, and GBP/USD, among others.

How Does Forex Trading Work?

In Forex trading, currencies are quoted in pairs, graphically represented as “base currency/quote currency”. The base currency is the first currency in the pair, and the quote currency is the second. The value of a currency pair fluctuates based on economic indicators, market sentiment, and geopolitical events. Traders profit from these fluctuations by buying a currency pair when they believe the base currency will strengthen against the quote currency, or selling when they anticipate a decline.

The Benefits of Online Forex Trading

There are several advantages to engaging in online Forex trading:

- High Liquidity: Due to the sheer volume of trading, the Forex market offers high liquidity, meaning assets can be easily bought or sold without significantly affecting the price.

- Low Transaction Costs: Online Forex trading typically involves low transaction costs, making it more appealing for both new and experienced traders.

- Leverage Opportunities: Forex brokers often provide leverage, allowing traders to control larger positions with a smaller amount of capital. However, this also increases the risk.

- Flexible Trading Hours: The Forex market operates continuously across various time zones, allowing traders to engage at virtually any hour.

Trading Strategies for Success

While Forex trading can be profitable, it also carries risks. Successful traders often rely on proven strategies, such as:

1. Scalping

Scalping is a short-term trading strategy that involves making dozens or hundreds of trades a day to capitalize on small price movements. Scalpers often hold positions for only a few minutes.

2. Day Trading

Day traders open and close positions within the same trading day, avoiding overnight risks. This strategy requires careful market analysis and the ability to react quickly to price changes.

3. Swing Trading

Swing trading aims to capture price swings over a few days to several weeks. Traders analyze technical indicators to determine entry and exit points, taking advantage of market volatility.

4. Position Trading

Position trading is a long-term strategy based on fundamental analysis. Traders hold positions for weeks, months, or even years, focusing on overall market trends rather than short-term price action.

Choosing the Right Forex Broker

Selecting a reliable Forex broker is crucial to your trading success. Here are key factors to consider:

- Regulation: Ensure the broker is regulated by a recognized authority, which adds a layer of security.

- Trading Platform: The broker’s trading platform should be user-friendly and equipped with essential tools and features for analysis.

- Spreads and Commissions: Review the broker’s commission structure and ensure that spreads are competitive.

- Customer Support: Reliable customer support is essential for prompt assistance, especially in highly volatile trading sessions.

Risk Management in Forex Trading

Effective risk management is vital in Forex trading to protect your capital. Here are some key strategies:

- Set Stop-Loss Orders: These orders automatically close your position when a certain loss threshold is reached.

- Diversify Your Portfolio: Avoid putting all your capital into one trade. Diversification can mitigate risks.

- Risk Only What You Can Afford to Lose: Determine your risk tolerance and stick to it, only investing money you are willing to lose.

Conclusion

Online Forex trading presents lucrative opportunities for those willing to invest time and effort into understanding the market. By mastering trading strategies, managing risks, and choosing a reputable broker, traders can navigate the complexities of Forex trading effectively. Continuous learning and adaptation are key, as the Forex market is dynamic, requiring ongoing education and the ability to respond to changing market conditions. Whether you are starting your trading journey or looking to enhance your skills, the Forex market offers vast potential for financial growth.